Get the free de34 form

Show details

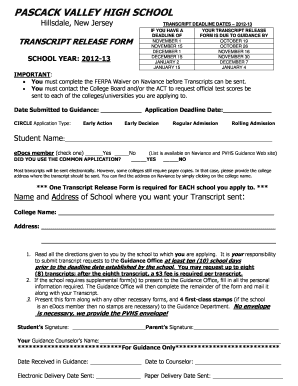

REPORT OF NEW EMPLOYEE(S) (DE 34) PRINTING SPECIFICATIONS COMPUTER OR LASER GENERATED ALTERNATE FORMS The Employment Development Department (EDD) provides Report of New Employee(s) (DE 34) forms suitable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your de34 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de34 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing de34 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit de 34 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out de34 form

How to fill out de34:

01

Gather all the required information such as personal details, employment history, and income information.

02

Fill out each section of the form accurately and completely.

03

Double-check all the information provided to ensure its accuracy and legibility.

Who needs de34:

01

Individuals who are applying for certain government benefits or services may be required to fill out de34.

02

Employers may also need to fill out de34 when reporting employee wages to the appropriate government agencies.

03

It is recommended to consult the specific guidelines and requirements of the organization or government agency requesting de34 to determine if it is necessary.

Fill de 34 online : Try Risk Free

People Also Ask about de34

Where do I report new hires in California?

What documents are needed to work in California?

What forms are required for new hire in California?

Do I have to report new employees to EDD?

What is CA de34?

What to do when you hire a new employee in California?

What is the meaning of new hires?

What is required for new hires in California?

What is the fax number for California new hire?

How do I hire a new employee in California?

How do I submit de34?

What forms do California employees need to fill out?

What forms need to be filled out for a new employee?

What is the de34 form filed with?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file de34?

The DE 34 form, also known as the Employer's Report of Occupational Injury or Illness, is typically filled out and filed by employers in the state of California. It is used to report any workplace injuries or illnesses that result in the loss of a full day's work or require medical treatment beyond first aid.

How to fill out de34?

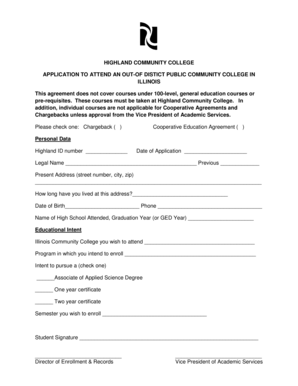

To fill out the DE34 form, also known as the California Employment Development Department (EDD) registration, follow these steps:

1. Download or obtain the DE34 form: You can find the form on the EDD website (www.edd.ca.gov) or visit your local EDD office to request a physical copy.

2. Provide general information: Start by entering your legal business name, trade name (if applicable), mailing address, physical address (if different), and EIN (Employer Identification Number) or Social Security Number (if a sole proprietor).

3. Select appropriate business type: Indicate the type of business entity you are registering by checking the corresponding box (e.g., sole proprietorship, corporation, partnership, etc.).

4. Determine your liability status: Depending on your specific circumstances, you may need to select specific liability statuses such as "Subject Employment," "Non-Subject Employment," "Agricultural Labor," or "Domestic Labor."

5. Provide ownership and organization information: If you are operating as a sole proprietor or partnership, list the names, addresses, and Social Security Numbers of the owners or partners. If you are a corporation, provide the names, addresses, and Social Security Numbers of all officers and directors.

6. Determine your payroll status: Choose whether you have employed or expect to employ workers in the next 90 days. If so, indicate the number of employees you anticipate, including yourself.

7. Determine your employment status: Indicate whether you are subject to State Disability Insurance (SDI) and/or Unemployment Insurance (UI) by checking the relevant boxes.

8. Determine your tax options: Select the tax options that apply to your business, such as Personal Income Tax (PIT) withholding, UI tax, Employment Training Tax (ETT), or State Disability Insurance (SDI). Check the appropriate boxes as per your requirements.

9. Review and sign the form: Ensure that all the information provided is accurate and complete. Sign and date the form in the designated section.

10. Submit the form: After filling out the DE34 form, submit it either online through the EDD website or by mailing it to the address provided on the form.

Remember, it is crucial to read the instructions thoroughly and seek professional advice if required, as the process may vary depending on your individual circumstances.

What is the purpose of de34?

Based on the information provided, it is not clear what specifically "de34" refers to. It could be a code, a product model, or a particular context that is not explicitly mentioned. Therefore, it is not possible to determine the purpose of "de34" without further clarification.

What information must be reported on de34?

DE34 is a form used by employers in California to report the wages and withholdings for each employee during a specific quarter. The information that must be reported on DE34 includes:

1. Employer information: This includes the employer's name, address, and federal employer identification number (FEIN).

2. Employee information: This includes each employee's name, social security number, and address.

3. Quarter and year: The form must specify the quarter and year for which the wages and withholdings are being reported.

4. Wages and tips: The form requires employers to report the total wages paid to each employee, including tips and other compensation.

5. Withholdings: Employers must report the amount of federal and state income tax withheld from each employee's wages during the quarter.

6. Deposit amounts: This section requires employers to enter the dates and amounts of any tax deposits made using the Electronic Funds Transfer (EFT) system.

7. Signature and date: The form must be signed and dated by the employer or authorized representative.

It is important for employers to accurately report this information on DE34 to ensure compliance with tax regulations and to avoid penalties or fines.

What is the penalty for the late filing of de34?

The DE34 form, also known as the Quarterly Contribution Return and Report of Wages (QCRW), is used by employers in California to report their employment taxes. If a DE34 form is filed late, the penalty may vary depending on the specific circumstances and the discretion of the California Employment Development Department (EDD).

However, generally speaking, if an employer fails to file the DE34 form by the due date, the EDD may impose penalties and interest charges. The penalties may be based on a percentage of the total contributions due, with the percentage increasing for each additional month the filing is delayed. Additionally, interest may accrue on the unpaid contributions and penalties.

It is important to consult the official guidelines and regulations provided by the California EDD or seek professional advice to determine the specific penalties and interest charges associated with the late filing of the DE34 form in your particular situation.

How can I modify de34 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including de 34 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in de 34 form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your de34 online, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete ca de34 on an Android device?

On Android, use the pdfFiller mobile app to finish your de34 form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your de34 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 34 Form is not the form you're looking for?Search for another form here.

Keywords relevant to fillable de 34 form

Related to de 34 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.